Low interest rates also have apps. 30 yr., 40 yr., 15 yr., conforming, adjustable, 1 yr, 5 yr jumbo and more. Oh they are getting the best reception in years.

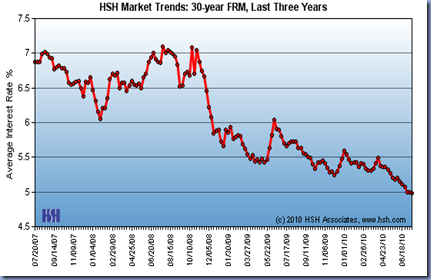

You may not see the lines out the door but look at the stack of files on the loan agents’ desks. We are in record low territory. Rates have never been this low in the 50 years of record keeping. How low? Below 5% fixed for the next 30 years. 3.75 fixed for the next 15 years. That’s how low. If you are buying you must understand these are not normal times. Take advantage. Jump in. What other industry will fix their price for the next 30 years. Ask the gas station on the corner if you would commit to buying your gas there for the next 30 years will they hold today’s price.

Homeowners, no matter when you re-financed last review the situation again with your loan agent. If you do not have one I can recommend some I work with.

A note to both homeowners and home buyers: If you are comparing rates you must compare at the same time. Interest rates fluctuate throughout the day and you want to be sure you are comparing apples to apples. You want to know what the fees will be. Also I strongly suggest you work with a person you have worked with previously or you know someone who has. The reason being a lender can quote any rate in a conversation but it is another issue to honor when reality comes. Also I suggest going with someone that only does loans. The lending rules, programs and policies are changing daily. One must be in the market continuously to be on top of it all. Going in and speaking to your favorite bank teller is not recommended. Call me and I will give you some names.

In today’s market if you put down 20% or have 20% in equity you will get the best rates. Interest rates break at $417,000 and below, at $729,750, and then again over the $729,750 each bank has their own policy. You can obtain financing with only 3.5% down or in equity. Yes you have to pay a little premium but that is nothing as compared if interest rates increase. The average interest rate over the last 25 years is about 8 %. Right now it is like the day after Christmas sale. It is almost half price. It was not that long ago that we had 14-18% interest. Try it! You will like it!

When refinancing you want to consider how long you will live in the home, how much of your present payment is going towards principal and how much will go with your new payment. It used to be if you can lower your rate by 2% then it is worth the while to refinance. I don’t think there is any real number that says you should refinance. It is a personal choice based on your finances and your goals. I suggest multiplying your old payment by the remaining term and or how much longer you think you will be in your home. Compare that cost vs. the cost at your new rate. Then compare your remaining balance. Many home buyers are putting in cash to buy the loan down to get the lowest rates and to have 20% equity. Many are re-financing into 15 year loans. Keeping the payments about the same but paying off the home in half the time. Some are financing and taking money out to buy investment property. This is an opportunity not to pass up. Talk to your accountant, real estate agent, mortgage person, financial advisor and or fortune teller.

Homebuyers don’t realize how good it is today. Let me quickly review some numbers. If you qualified last year for a $400,000 loan when rates were 5.5%, today you can qualify for $450,000 and have the same payment. Today a $400,000 loan will cost about $2000 a month. Last year that same loan wild cost almost $300 more. Don’t wait any longer. We in the business are surprised how low rates are and how long they have been low. My crystal ball tells me rates will increase but it won’t commit to when. Buying a home is an exciting and nerve racking event. With a good team (real estate agent, lender, and inspectors) supporting you we can help alleviate a lot of the stress. Call me toll free at 877-Lee-Sells and I will refer you to the good lenders I work with.

To read more click on: http://articles.sfgate.com/2010-06-24/business/21925746_1_mortgage-rates-track-michael-fratantoni-average-rate

No comments:

Post a Comment